Get the free vat 201 form pdf download

Show details

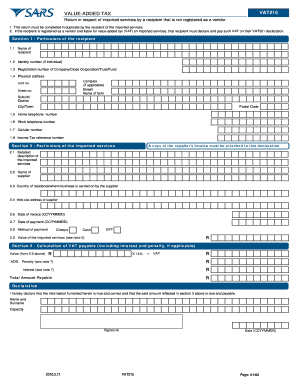

FORM 201C APPENDIX TO FORM 201 List of inventory See sub-rule 2 of rule 19 Balance of stock at the end of the tax period ending on. R*C. No* Name and style of business Tax period M/s. From. To. Godown No 1. Address. Sr No* Name of commodity HSN code opening balance Quantity incoming outgoing during the tax period closing approximate value of closing Note - The above information should be furnished in respect of all the places of business and a separate sheet should be attached wherever...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vat 201 form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat 201 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vat 201 form pdf download online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vat 201 form in excel format. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out vat 201 form pdf

How to fill out VAT 201 form in:

01

Start by gathering all the required information and documents such as your business details, VAT registration number, and sales records.

02

Fill in your business information in the appropriate sections of the form, including the name, address, and contact details.

03

Provide your VAT registration number and indicate the VAT period you are reporting for, whether it is monthly or quarterly.

04

Record your total sales and outputs in the relevant boxes of the form, ensuring that you include both the standard and zero-rated sales separately.

05

Deduct any exempt sales or sales to VAT-registered customers within the European Union.

06

Calculate the VAT due by applying the correct VAT rate to your taxable sales. This should be recorded in the appropriate box on the form.

07

If you have any purchases or input VAT to claim, provide the necessary details in the relevant sections of the form.

08

Include any adjustments to your VAT liability, such as bad debts or changes in VAT rates, in the appropriate boxes.

09

Check all the entries on the form for accuracy and ensure that you have included all the necessary information.

10

Sign and date the form, and submit it to the relevant tax authority within the specified deadline.

Who needs VAT 201 form in:

01

Businesses registered for VAT in the applicable jurisdiction are required to fill out the VAT 201 form.

02

Individuals or entities that have reached the turnover threshold specified by the tax authority for VAT registration purposes must also complete this form.

03

Companies involved in the supply of goods or services subject to VAT are mandated to file the VAT 201 form to report their sales, purchases, and VAT liability accurately.

Fill blank vat form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

When is the deadline to file vat 201 form in in 2023?

The deadline to file VAT 201 form in 2023 is the end of the month following the end of the tax period. For example, if the tax period is January 2023, the deadline to file VAT 201 form is February 28th, 2023.

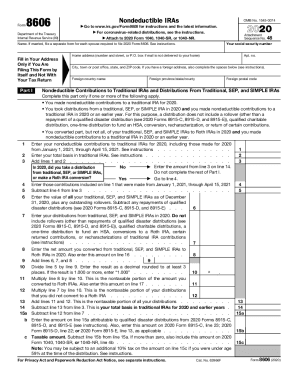

What is vat 201 form in?

VAT 201 form is used in the United Kingdom for Value Added Tax (VAT) purposes. It is a form that businesses must fill out and submit to HM Revenue and Customs (HMRC) to report their VAT liabilities and claims. The form includes details about the VAT charged on sales, VAT payable on purchases, and any VAT refunds or credits claimed.

Who is required to file vat 201 form in?

The VAT 201 form must be filed by businesses that are registered for the Value Added Tax (VAT) in the relevant country. The specific requirements for filing may vary depending on the jurisdiction, so it is best to consult the local tax authority or seek professional advice to determine if you are required to file this form.

What is the purpose of vat 201 form in?

The VAT 201 form, also known as the Value Added Tax Return, is used for filing Value Added Tax (VAT) returns in certain countries. The purpose of this form is to report the amount of VAT charged on sales, as well as the amount of VAT paid on purchases, during a specific period. It helps businesses calculate their VAT liability or refund due to them. This form helps the tax authorities in monitoring and collecting VAT from businesses accurately.

What information must be reported on vat 201 form in?

VAT 201 form refers to the value-added tax (VAT) return form that businesses in certain countries need to fill out and submit to report their VAT liabilities and claim VAT refunds. The specific information that must be reported on the VAT 201 form may vary depending on the country's VAT regulations and reporting requirements. However, generally, the VAT 201 form includes the following information:

1. Business identification: Name, address, and VAT registration number of the taxpayer (business).

2. VAT period: The specific period for which the return is being filed (e.g., monthly, quarterly, or annually).

3. Sales and outputs: Total value of taxable supplies made (sales) during the VAT period, including the VAT amount charged on these supplies.

4. Purchases and inputs: Total value of goods and services purchased (inputs) during the VAT period, including the VAT amount paid on these purchases.

5. VAT payable: Calculated by subtracting the input VAT from the output VAT, this represents the VAT amount owed to the tax authority.

6. VAT refundable: If the input VAT exceeds the output VAT, a taxpayer may be eligible for a VAT refund. This section includes the amount that can be claimed as a refund.

7. Payments: If there is a VAT liability, the taxpayer needs to report the payment details, such as the payment method and the amount paid.

8. Adjustments: Any adjustments or corrections made to the VAT liability of previous periods, if applicable.

9. General information: Additional information, such as changes in business details, special exemptions or deductions claimed, or any other relevant information required by the tax authority.

It is important to note that the specific details and format may differ, so businesses should refer to their respective country's VAT regulations and consult with a tax professional for accurate guidance on filling out the VAT 201 form in their jurisdiction.

What is the penalty for the late filing of vat 201 form in?

The penalty for the late filing of VAT 201 form can vary depending on the country or region where the form is being filed. In some jurisdictions, a fixed penalty amount may apply for each month or specified period of delay in filing the form. Additionally, there may be additional penalties or interest charges imposed on any late payment of taxes owed. The specific penalty amount and consequences for late filing should be referenced in the tax regulations of the relevant jurisdiction. It is advisable to consult with a tax professional or local tax authorities to obtain accurate and up-to-date information regarding the penalties for late filing of VAT 201 form in a specific location.

How do I execute vat 201 form pdf download online?

pdfFiller makes it easy to finish and sign vat 201 form in excel format online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the vat201 form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your vat 201 form example in seconds.

How do I fill out vat 201 form using my mobile device?

Use the pdfFiller mobile app to complete and sign vat 201 template form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your vat 201 form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

vat201 Form is not the form you're looking for?Search for another form here.

Keywords relevant to vat201 form download

Related to vat201 form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.